View the log of your minFraud transactions

You can use the minFraud transactions page to view a log of submitted transactions. We retain minFraud transaction data for up to 5 months.

This feature is available to admin users and standard users with product/service permissions. Learn more about user permissions.

In addition, you could integrate the minFraud service to take risk scores and risk data returned through API queries and incorporate this data into your own logging system. Full integration documentation, which developers and engineers can use to integrate minFraud API responses into a local system, can be found on our developer portal.

How to view the log of your minFraud transactions through the account portal

Click on 'minFraud Transactions' in the minFraud menu in your account portal [direct link, login required].

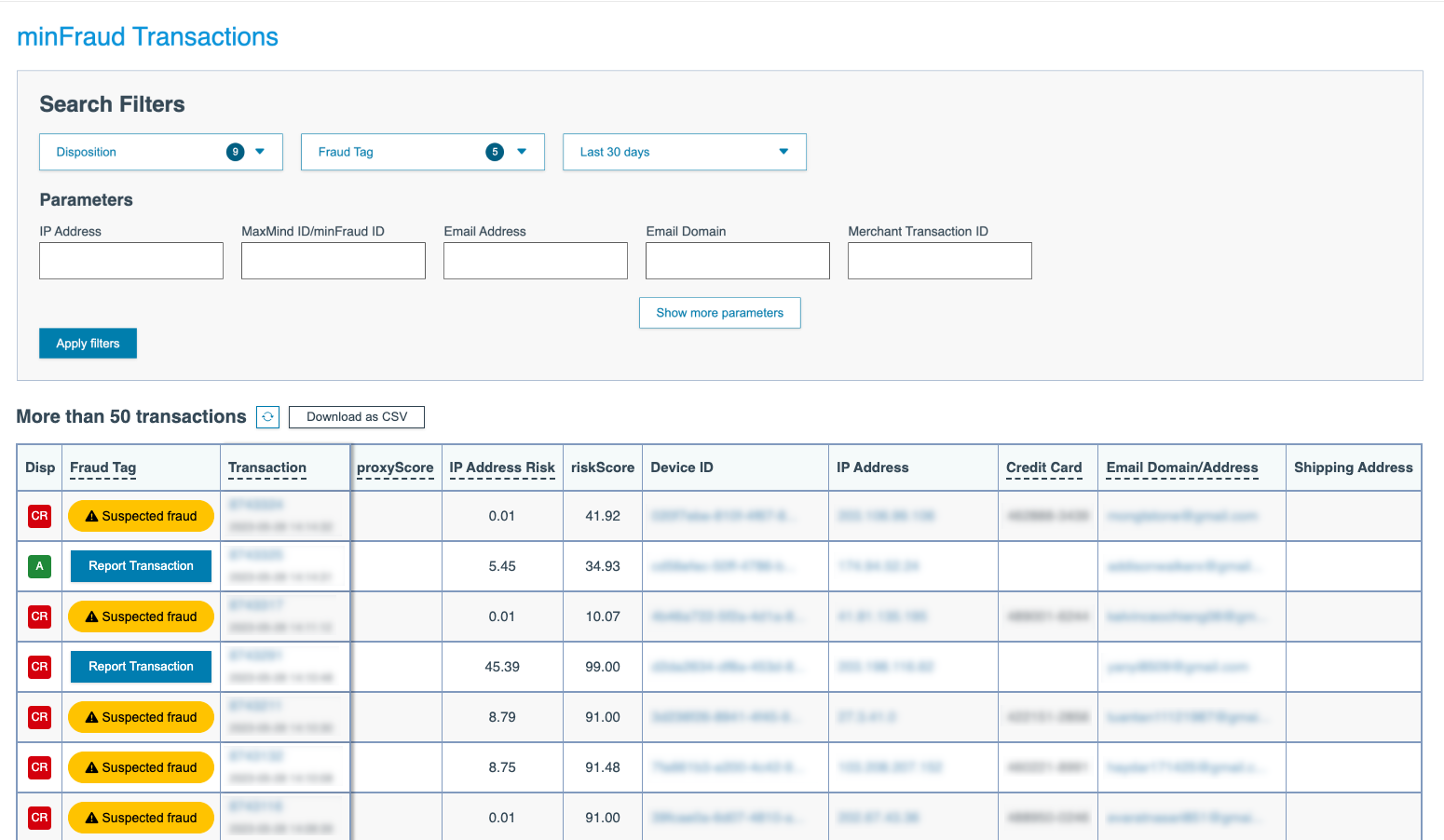

The minFraud transactions page will display a list of transactions submitted by your account. By default, this page will display up to 50 transactions submitted in the last 30 days, but you can filter, search, and change the number of transactions displayed per page.

On the transaction overview screen, you can see the following information for each transaction:

- The transaction disposition (learn more about custom rules and dispositions), which could be:

- accept - the default disposition, represented by a green A

- reject - represented by a red MR

- review - represented by a red CR

- test - represented by a purple T

- manual review expired - represented by a gray X

- no disposition - represented by a white box with a slash through it

- The fraud tag, if you have set one. If you have not, this will be a link allowing you to report fraud, chargebacks, and false positives on this transaction. Learn more about reporting transactions.

- The transaction ID. If you click on the transaction ID, you can review additional information regarding the transaction. Learn more about reviewing transactions.

- The time the transaction was submitted to the minFraud service.

- The proxyScore, for minFraud legacy transactions only.

- The IP risk score. Learn about the IP risk score.

- The overall risk score. Learn about the overall risk score.

- The Device ID for transactions that were submitted using minFraud Insights or Factors, and device tracking. You can click on this link to see a list of all transactions in the last four months that have the same Device ID. Learn more about device tracking.

- The IP address submitted for this transaction. This should be the IP address of the end-user who initiated the transaction. You can click on this link to see a list of all transactions in the last four months submitted with this IP address.

- The credit card submitted for this transaction. This will display up to 20 characters of the credit card token. You can click on this link to see a list of all transactions in the last four months that have the same credit card token.

- The email address and/or email domain submitted for this transaction. The email address may be hashed, depending on your integration. You can click on this link to see a list of all transactions in the last four months submitted with this email.

- The shipping address submitted for this transaction. You can click on this link to see a list of all transactions in the last four months submitted with this shipping address.

- The billing phone number submitted for this transaction. You can click on this link to see a list of all transactions in the last four months submitted with this billing phone number.

Download the log of transactions

You can also download a CSV (comma separated values) format file of the transactions on this screen by clicking the download button next to the displayed number of transactions.

You can also learn more about searching your log of minFraud transactions.