Credit card risk data

Credit card risk data includes:

- detection of prepaid and virtual cards,

- as well as the brand of the credit card,

- the country in which the card was issued,

- and various matches between information provided by the user and the issuer of the card.

These data points will only be returned when you pass the issuer ID number (IIN) of the card as an input to the minFraud Insights and Factors web services.

There is an additional data point that can be used for manual review related to the credit card issuer if you pass the billing address to the minFraud services. Learn more about billing address risk data.

There are also additional data points that may be useful if you ask your customers to provide the name and phone number of their bank and pass this data to the minFraud services.

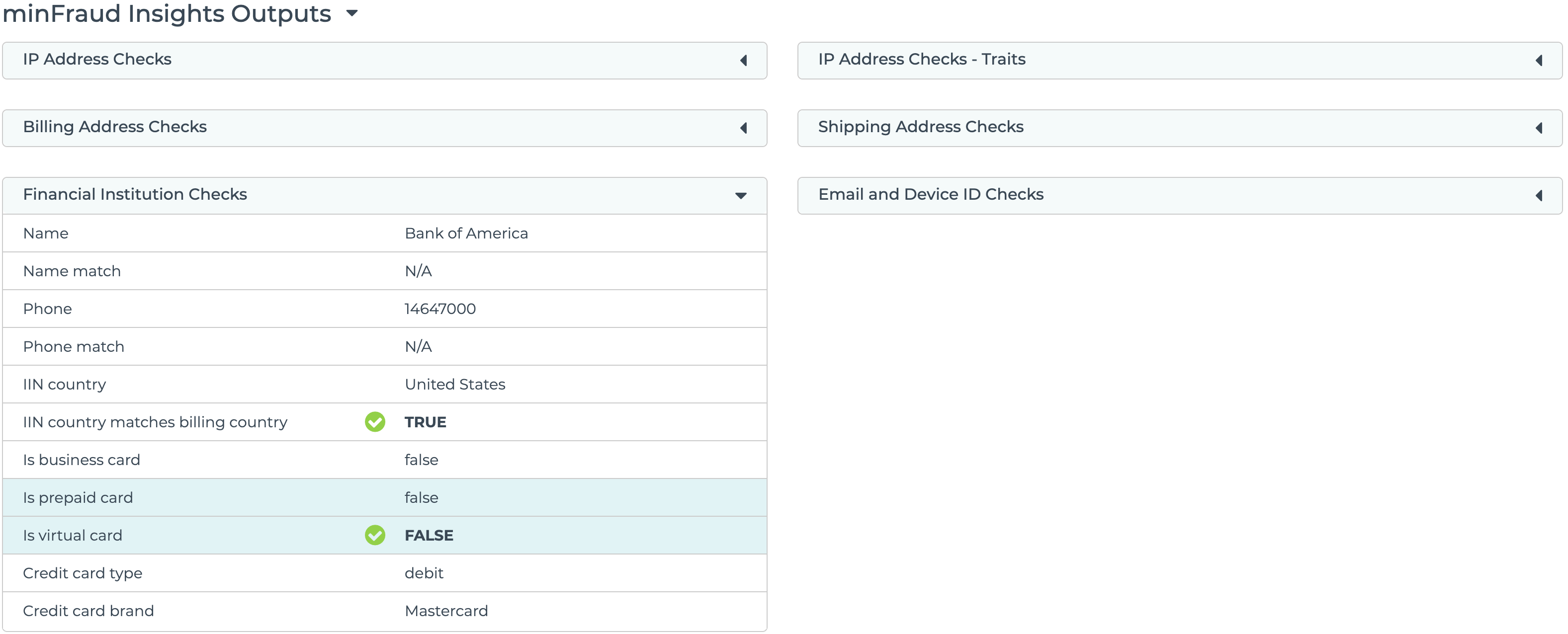

Prepaid and virtual card detection

The minFraud services flag prepaid and virtual credit cards. Customers may use a prepaid gift card for any number of reasons. They are easy to purchase, and can be acquired without linking them to a name, address, and other biographical details. If you are concerned that a customer may be trying to hide their identity and their card is prepaid, that may be an indicator of greater risk.

Prepaid and virtual card detection is displayed under Financial Institution Checks in the transaction review screen in the account portal. Learn how to review transactions using the account portal.

Virtual cards

Virtual cards do not have a physical card associated with the card number. Customers may use virtual cards for added security, though they are also popular with resellers who use them to attempt to bypass order limits.

You can read the API specifications for virtual card detection on our developer portal:

Prepaid cards

Customers may use a prepaid gift card for any number of reasons. They are easy to purchase, and can be acquired without linking them to a name, address, and other biographical details. If you are concerned that a customer may be trying to hide their identity and their card is prepaid, that may be an indicator of greater risk.

You can read the API specifications for prepaid card detection on our developer portal:

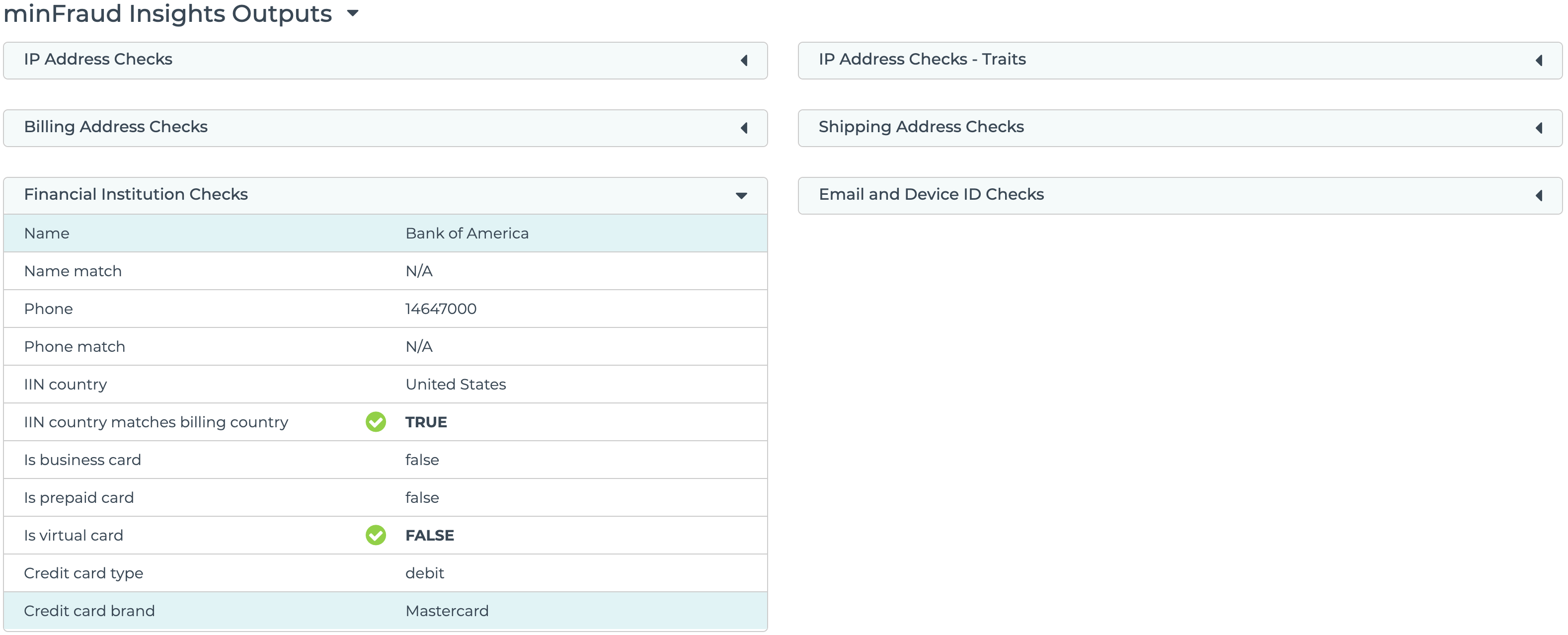

Credit card brand and name

Using the card brand and name in combination with other data points can help identify fraud trends over time. For example, you may notice a fraud attack coming from Visa prepaid cards or American Express cards from certain countries. These trends may emerge based on the characteristics of stolen cards from data breaches.

Credit card brand and name are displayed under Financial Institution Checks in the transaction review screen in the account portal. Learn how to review transactions using the account portal.

You can read the API specifications for card brand detection on our developer portal:

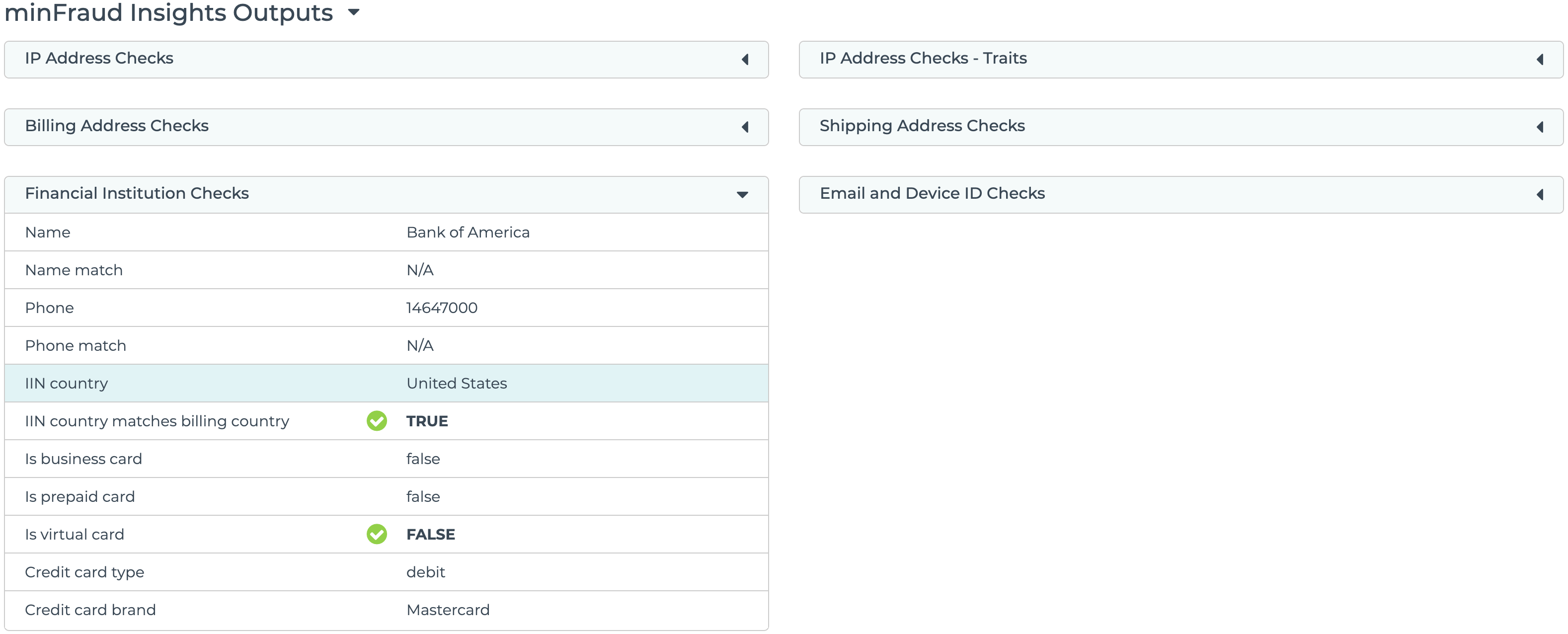

Credit card country

You can check the country in which the credit card was issued against other details from the transaction and customer history. If there is some discrepancy between where the card was issued and where the customer is located, or attempting to ship a product, that may indicate a higher risk.

Credit card country is displayed as "IIN country" under Financial Institution Checks in the transaction review screen in the account portal. Learn how to review transactions using the account portal.

You can read the API specifications for card country detection on our developer portal:

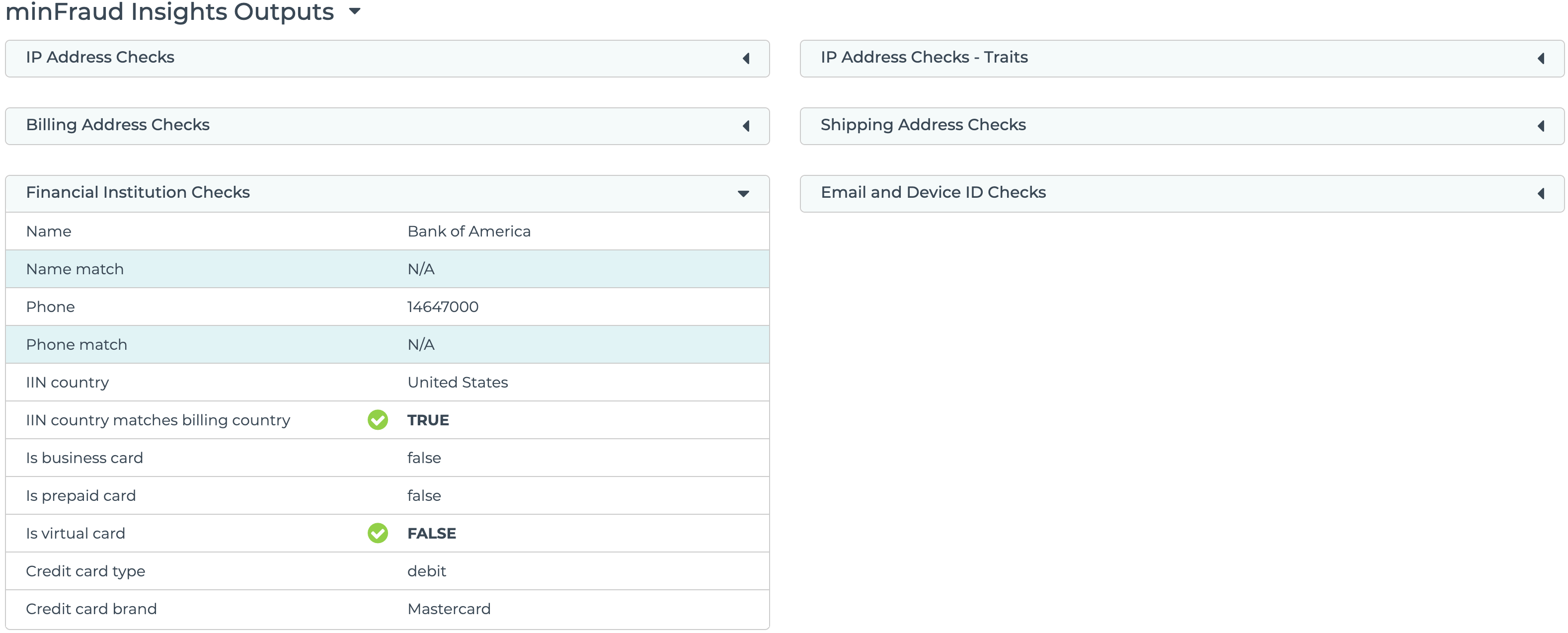

Credit card matching

Some merchants ask their users to enter in the name of their issuing bank as an additional verification step. The minFraud service will check the name and phone number of the issuing bank for a credit card against the name and phone number of the bank as provided by the end user.

Credit card name and phone number matching is displayed under Financial Institution Checks in the transaction review screen in the account portal. Learn how to review transactions using the account portal.

You can read the API specifications for card matching on our developer portal: