Report transactions

The minFraud service allows you to report feedback on transactions, which will help fine-tune your risk scoring. For example, if the minFraud service returns a high risk score for a transaction, and you determine that the transaction was legitimate, you can report the transaction as 'not fraud.' Alternatively, if the minFraud service returns a low risk score for a transaction, and the transaction is later subject to a chargeback, is suspected as being fraudulent, or is determined to be spam or abuse, you can report the transaction to us with the corresponding tag. Feedback through transaction reports is also helpful when the risk score is accurate, such as a high risk score on a transaction that you suspect is fraudulent, as this helps reinforce associated patterns that minFraud has learned. Reports can be submitted through the API or your account portal as described below.

Reporting transactions is highly recommended and helps us detect 10-50% more fraud for you and helps reduce your false positives:

- We build custom machine learning models for you based on your reports.

- Transaction reports help our models continually adjust to the latest fraud trends.

- We manually review reported transactions to identify customizations and algorithmic improvements for your account.

- The risk scores of future transactions will adjust when it is possible to link them to previous transaction reports through IP address, email, device, phone, or shipping address.

- Finally, they help to ensure that changes we make are a net benefit to you as we evaluate how risk scores would have changed on your previous transaction reports before deploying updates to minFraud.

Types of transaction reports

minFraud currently accepts four kinds of transaction reports, detailed below:

| Report type | Description |

|---|---|

| Chargeback | Used to associate a chargeback with a transaction |

| Not fraud | Used to report a transaction that was later identified as a false positive |

| Spam or abuse | Used to report a transaction that was linked to spam or abuse |

| Suspected fraud | Used to report a high risk transaction where fraud has not yet been confirmed |

If you report a transaction with one of the types listed above, and later need to change the report type, you can submit a new report with the new report type, and the transaction will be updated. There can be multiple reasons that a chargeback was filed by a customer and chargebacks should only be reported to MaxMind if you desire future related transactions to increase in risk. Chargebacks due to merchant error or a customer service issue should not be reported to MaxMind, for example.

If you're not sure which type of report to send for your specific use case, please feel free to reach out to our support team to discuss your situation.

Report transactions using our API

Our client APIs all have the ability to report transactions built into them. Learn how to use our client APIs to report transactions in our developer documentation.

In addition to our client APIs, we maintain an HTTP API that can be used to report transactions as well. Learn how to use our HTTP API to report transactions in our developer documentation.

Report transactions using your account portal

There are two methods for reporting transactions through your account portal. You can report transactions through a special form dedicated to the purpose, or you can report transactions through the transaction review screen. This feature is restricted to admin users and users with product/service permissions. Learn more about user permissions.

Report a Transaction form

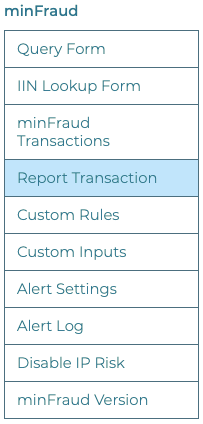

To access the Report a Transaction form, click on the ‘Report Transaction’ link in the minFraud menu in your account portal [direct link, login required].

Next, you should complete the form. Minimally, you will need the IP address of the customer or end-user that was submitted for the transaction, and the type of report you are submitting. See the description of different report types, above.

In addition, you can provide the following optional items:

- The chargeback code provided by the bank, where applicable.

- The transaction ID, an optional unique ID from your own system that can be passed to the minFraud service for every transaction. You can read the API specification for the transaction ID input in our developer documentation.

- The minFraud ID or MaxMind ID of the transaction. These are unique IDs passed as outputs of the minFraud services to identify transactions. Depending on your integration, you may have a record of these IDs you can reference. The minFraud ID is used by minFraud Score, Insights, and Factors, while the MaxMind ID is used by minFraud Legacy services. You can read the API specification for the minFraud ID in our developer documentation, or read the API specification for the MaxMind ID in our minFraud Legacy documentation.

- Any notes you may have about the transaction that you would like our data review team to be aware of.

Once you have filled out the relevant information on the form, click the blue ‘Submit’ button.

minFraud Transactions review screen

You can also report a transaction directly from the minFraud Transactions review screen in your account portal. To access the minFraud Transactions review screen, click on the ‘minFraud Transactions’ link in the minFraud menu in your account portal [direct link, login required].

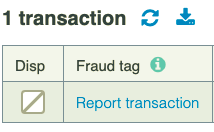

You can report any of the transactions in the displayed list. Click on the ‘Report transaction’ link in the ‘Fraud tag’ column for the transaction you would like to report. You will need to select a fraud tag from the dropdown list of options. See the description of different report types, which correspond to fraud tags, above.

You may optionally enter the chargeback code provided by the bank, where applicable, and any notes you may have about the transaction that you would like our data review team to be aware of.

When you're finished filling out the form, click on the blue ‘Save tag’ button to submit your report.