Risk score reasons

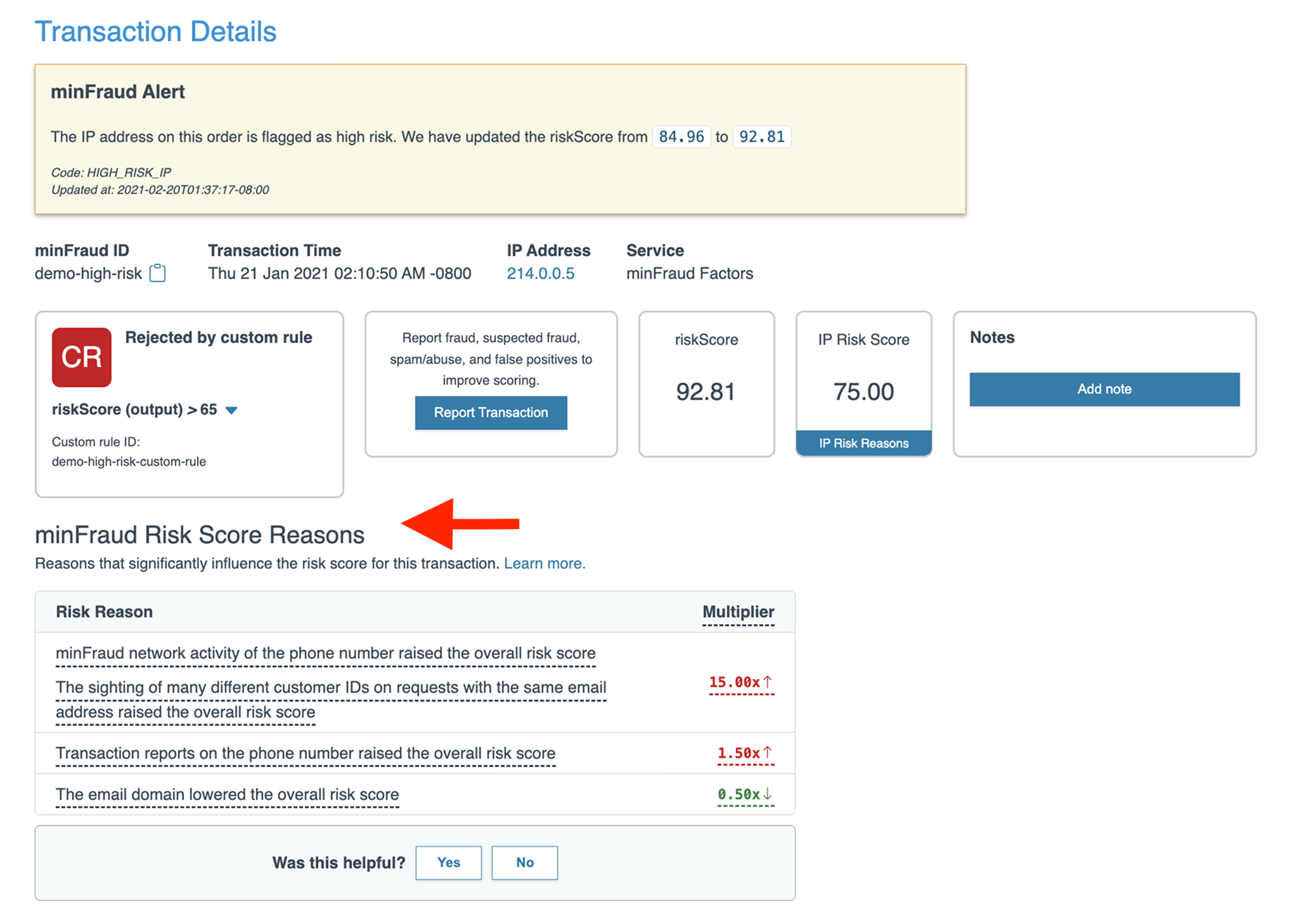

Risk score reasons are a set of data that provide you with specific and understandable reasons for why a risk score is high or low. This data is currently available for all minFraud service tiers on the Transaction Details page, and also via API for the minFraud Factors service. Learn more about risk scores.

Accessing minFraud Risk Score Reasons

Risk score reasons are present in the API response for queries sent to the minFraud Factors service. For more details, please see the technical documentation on our developer portal.

You can also view the risk score reasons for any individual transaction on the Transaction Details page in the Admin portal.

- Sign in to your MaxMind account and navigate to the minFraud Transactions page (direct link, login required).

- Click the transaction ID to open the Transaction Details page.

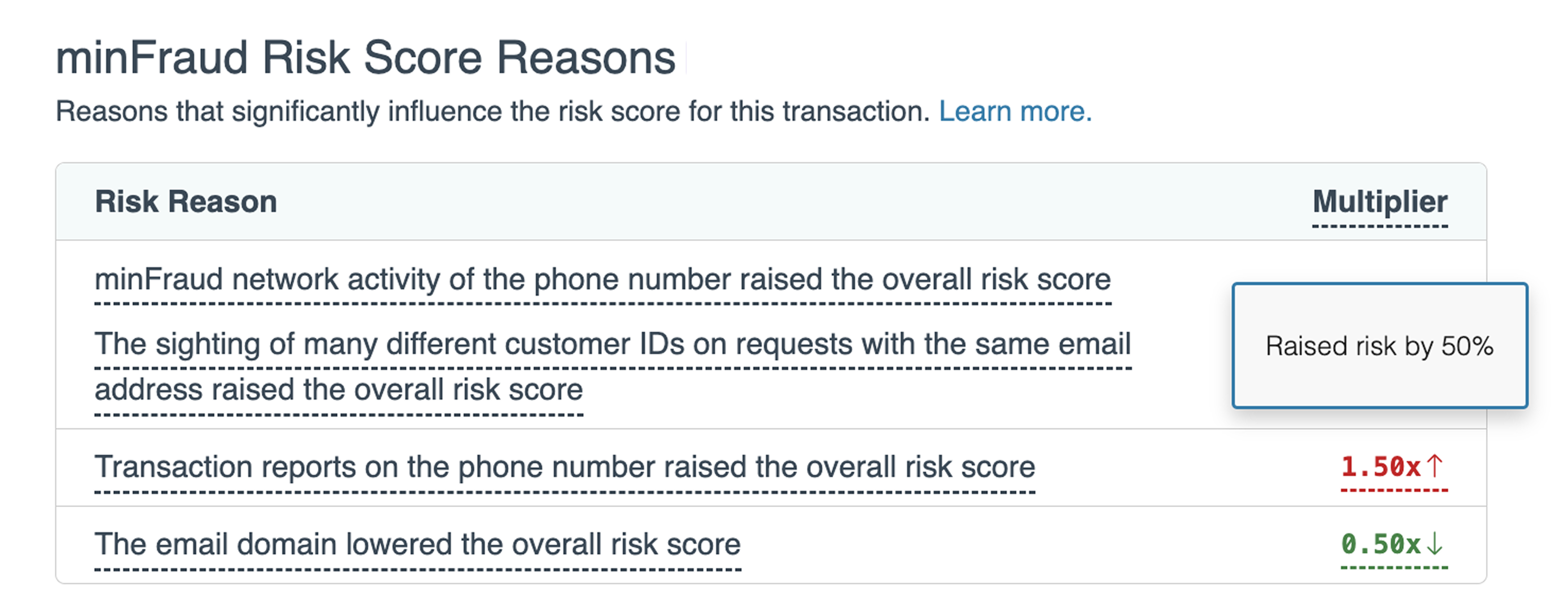

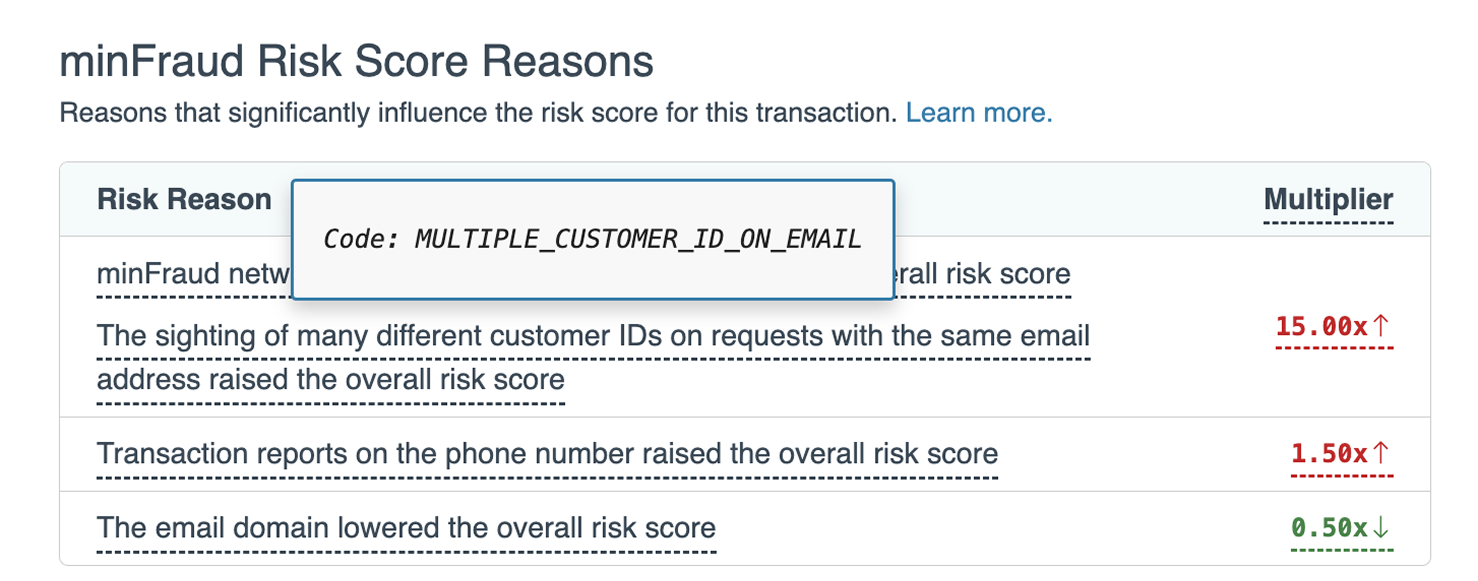

We return a risk multiplier value in addition to a reason code and a human-readable string. Not all risk score reasons are returned—only risk score reasons that change the risk score significantly for a given transaction are returned. Multipliers greater than 1.5 and less than 0.66 are considered significant and lead to risk reason(s) being present. Multipliers that increase risk are marked in red with an upward arrow. Multipliers that decrease risk are marked in green with a downward arrow.

To view the impact of a risk score expressed as a percentage, hover over the multiplier text.

To view the reason code associated with each risk reason, hover over the text under ‘Risk Reason’.

Recommended use cases

Risk score reasons provide fraud teams with the data needed to deeply understand risk patterns and make informed decisions.

- Use the data for forensic investigation. If you question the accuracy of a score for any reason, the risk score reasons can give you an understanding of what our model is doing. The multipliers give you a sense of the relative magnitude of each reason, and how they impact the overall score.

- Use the data for post-incident analysis. Take the mean multiplier of risk score reasons to get insight into what is driving the score for a given snapshot of time. You can analyze a specific target class, such as false negatives or false positives.

- Use the data for pattern analysis over time. Fraud patterns change constantly, so you can identify which patterns are driving the scores and fine-tune specific aspects of your fraud strategy accordingly.

- Use the data to feed your own machine learning models. Surface new features that add lift to your ML models with over 30 new data points that we consider high signal for fraud and risk applications.

Feedback

We would love your feedback on this feature. Reach out to us at customersuccess@maxmind.com to schedule a feedback session.